views

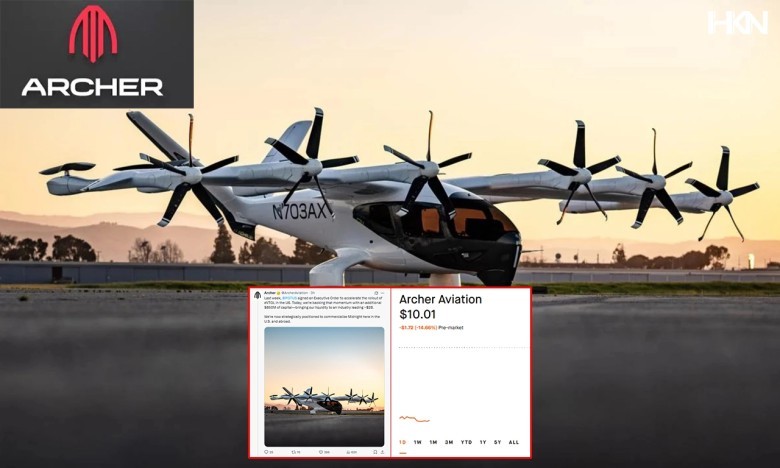

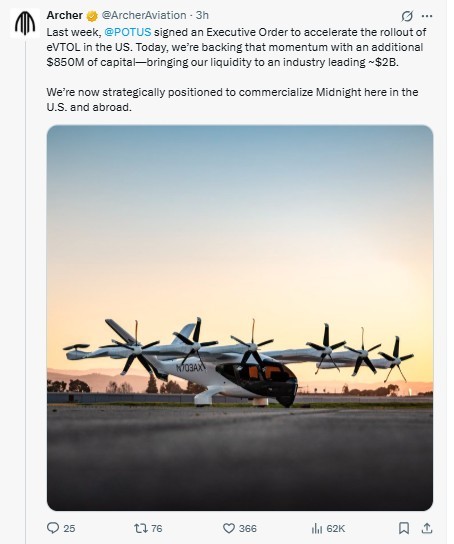

Archer Aviation’s shares dropped as much as 15% on Friday after the company confirmed an $850 million share sale. The company said the proceeds will go toward building infrastructure and launching a new aviation software platform powered by artificial intelligence. Archer also plans to use the money to support its Launch Edition air taxi program which will include air travel services for the 2028 Los Angeles Olympics.

“The offering included 85 million shares priced at $10 each and raised Archer’s pro forma liquidity to about $2 billion.”

Despite the selloff the company believes it is now in a stronger position to grow.Archer’s announcement came just after President Donald Trump signed an executive order launching a pilot program for electric vertical takeoff and landing vehicles. The new program aims to speed up the testing and rollout of eVTOLs in the U.S. Archer and its rival Joby Aviation both saw stock boosts earlier this week following the executive order.

Archer hopes the federal program will help clear regulatory paths faster. The company has already partnered with United Airlines to launch airport-based air taxi routes and has chosen the UAE as its first international launch market.

Archer Eyes Global Expansion amid Stock Market Setback

Demand for eVTOL technology has risen sharply as urban centers look for greener faster transit options. Companies like Archer argue their tech reduces emissions and eases traffic congestion. But challenges remain including airspace regulations safety approvals and public adoption. Archer’s Midnight eVTOL will be featured at the Paris Air Show this month and is expected to attract global attention from investors and governments. Though shares dropped CEO Adam Goldstein expressed confidence in Archer’s position and future.

![UC Davis Showdown: Student Shuts Down Hater with Powerful Defense of Trans Community [WATCH]](/upload/media/posts/2025-04/11/uc-davis-showdown-student-shuts-down-hater-with-powerful-defense-of-trans-community-watch_1744363407-s.jpg)