views

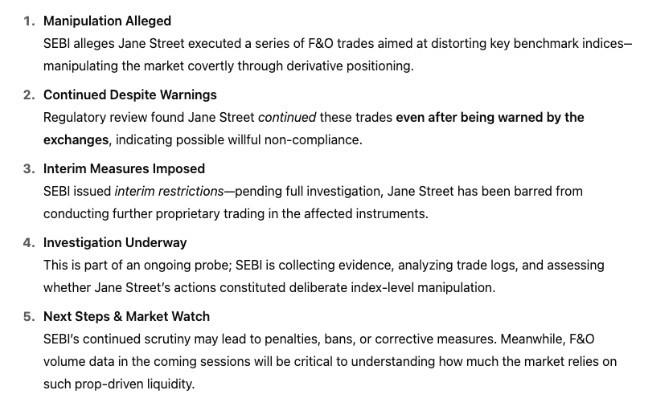

The Securities and Exchange Board of India has temporarily banned U.S. trading firm Jane Street from buying or selling securities in India. The action comes after the regulator accused the firm of manipulating markets for personal gain.

In an interim order issued Thursday SEBI said Jane Street’s actions lacked legitimate economic reasoning and distorted India’s major indexes. The order also froze over 48 billion rupees held by Jane Street in Indian banks.

SEBI Cracks Down On Jane Street Over Suspected Index Manipulation

According to SEBI Jane Street allegedly bought stocks and futures early in the day and sold them off later to drop the BANKNIFTY index. The firm then profited through larger positions in index options that gained value. The regulator said Jane Street continued these practices even after a warning in February.

“The integrity of the market and the faith of millions of small investors and traders can no longer be held hostage to the machinations of such an untrustworthy actor,” SEBI stated.

A UAE-based hedge fund president said traders observed the manipulation during live trading sessions. Options expert Mayank Bansal said SEBI’s action is the least the regulator could do.Jane Street responded that it operates under compliance globally and will cooperate with SEBI. However SEBI emphasized that the firm has shown disregard for local rules and cannot be trusted.

Experts such as Deven Choksey and Kranthi Bathini supported the ban. They said the regulator is right to act against players abusing the market and harming retail investors.SEBI also highlighted that foreign traders using complex algorithms gained while average investors lost money. India’s derivatives market remains a target for global firms but SEBI insists that integrity must be protected.

![UC Davis Showdown: Student Shuts Down Hater with Powerful Defense of Trans Community [WATCH]](/upload/media/posts/2025-04/11/uc-davis-showdown-student-shuts-down-hater-with-powerful-defense-of-trans-community-watch_1744363407-s.jpg)