views

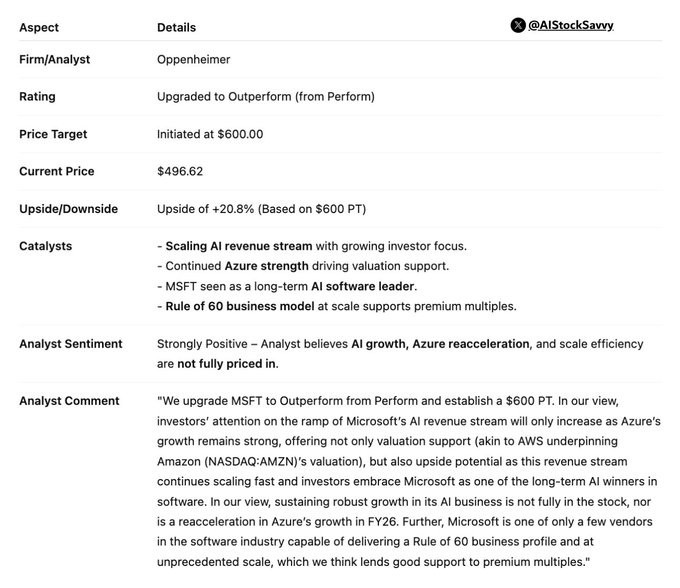

Oppenheimer upgraded Microsoft stock to “Outperform” on Tuesday and raised its price target to $600 per share which represents nearly a 21 percent gain from the company’s last closing price. The firm said Microsoft’s full artificial intelligence value has not been reflected in its current valuation. Microsoft has risen more than 17 percent in 2025 and is viewed as a top AI stock because of its partnership with OpenAI.

“Investors’ attention on the ramp of Microsoft’s AI revenue stream will only increase,” said analyst Brian Schwartz.

This collaboration powers key features across its software and cloud business. Oppenheimer expects the growth of AI demand to support Azure’s performance. The analyst said Microsoft’s AI strategy is poised to accelerate usage and revenue.

Azure AI May Be Underestimated

Brian Schwartz added that Azure’s AI capabilities could deliver long-lasting growth even if early feedback on tools like Copilot was mixed. Schwartz said Microsoft’s AI momentum could mirror Amazon’s AWS success and help drive future earnings.

However the firm also noted potential risks if companies shift AI budgets away from cloud platforms. Schwartz said some enterprises may hesitate to invest in tools that lack near-term commercial impact. But he said Microsoft’s deep ties with OpenAI and its strong position in enterprise software give it an edge. The analyst believes Azure could see reacceleration in 2026 if current trends hold.

Microsoft has also made job cuts this year in a broader reorganization plan. Despite that Schwartz said Microsoft’s cloud and AI growth remain compelling. The report concluded that Microsoft’s AI upside has not yet been priced in fully and that it will continue to lead the software industry as AI transforms the global economy.

![UC Davis Showdown: Student Shuts Down Hater with Powerful Defense of Trans Community [WATCH]](/upload/media/posts/2025-04/11/uc-davis-showdown-student-shuts-down-hater-with-powerful-defense-of-trans-community-watch_1744363407-s.jpg)